fsa health care limit 2021

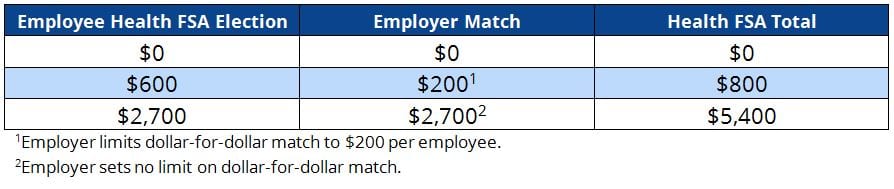

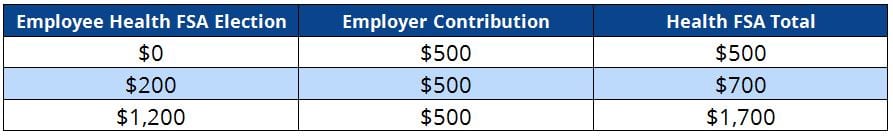

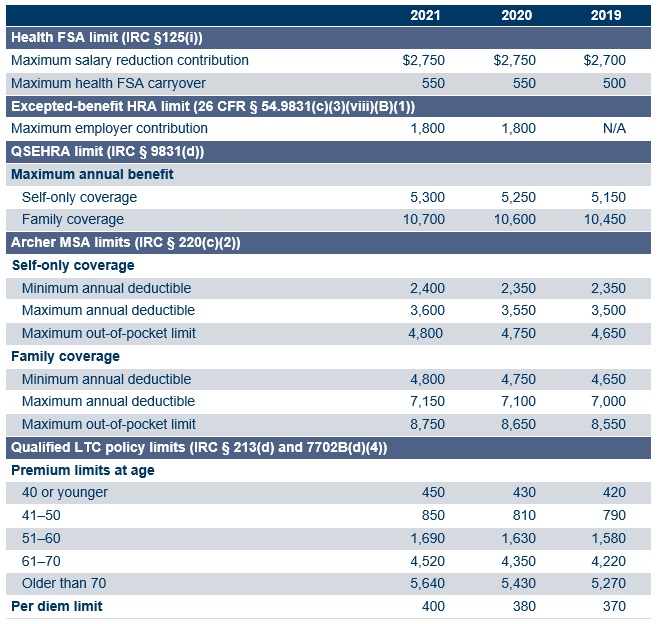

Employers may continue to impose their own dollar limit on employee salary reduction contributions to Health FSAs. Carryover Limit is IncreasedEffective for plan years starting on and after January 1 2020 Notice increases the 500 carryover limit for health FSAs to 20 of the annual salary reduction contribution limit.

Child Elderly Dependent Care.

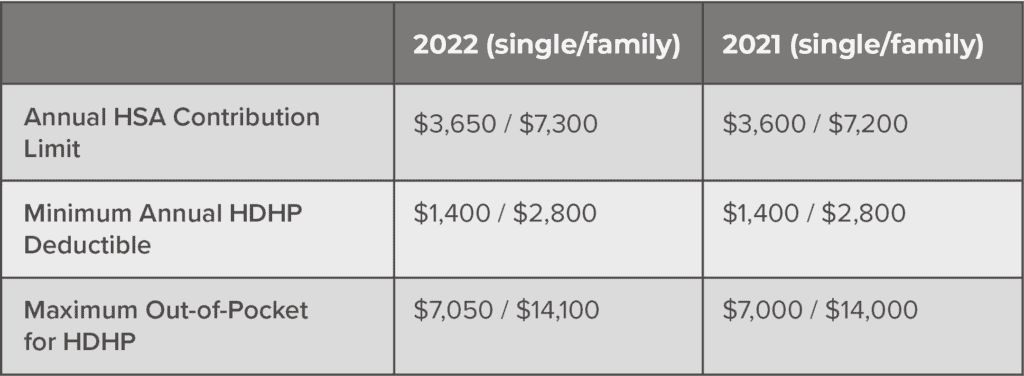

. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs. For 2021 the maximum amount of an employer subsidy for qualified. The health FSA contribution limit will remain at 2750 for 2021.

2021-R-0054 February 11 2021 Page 3 of 4 unused health and dependent care FSA funds are forfeited at the end of the plan year known as the use it or lose it rule IRS Notice 2005-42. This means youll save an amount equal to the taxes you would have paid on the money you set aside. The carryover amount of unused health FSA funds is increased to 550 up 50 from the 2020 limit of 500 for 2021.

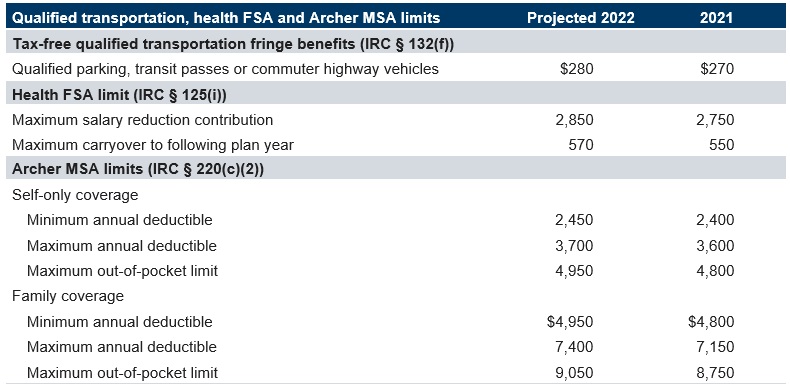

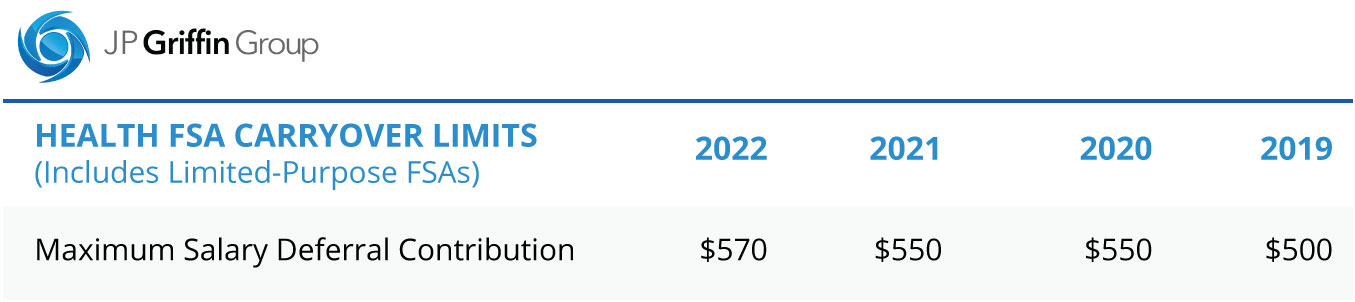

Beginning January 1 2022 Health FSA contributions are limited by the IRS to 2850 each year this is a 100 increase from 2021 limit of 2750. However carry over amounts have increased from 500 to 550 for any excess balance at the end of 2021 to be carried over into plan year 2022. Extension of claims periods for plan years ending 2020-2021.

2020-43 set the 2021 employer contribution limit for excepted-benefit HRAs while Notice 2020-33 increased the health FSA limit on 2020 carryovers to the 2021 plan year with future carryovers capped at 20 of the maximum employee pretax contribution to a health FSA for a plan year. This is an increase of 100 from the 2021. FSA rollover flexibility for carryover of unused amounts from 2020-2021 plan years.

The maximum the IRS let workers contributed this year was 2750 but employers may have lower contribution limits. The limit is set to stay the same in 2021 and it applies to all health FSAs which includes those accounts restricted to individual coverage such as vision or dental services. The IRS issued Notice 2021-15 which allowed flexibility for employers such as.

On May 12 2020 IRS released Notice 2020-33 which indexed the maximum Health Care FSA rollover 550 for plan years that begin or renew on or after January 1 2020The maximum that can be carried over from one plan year to the next is based on 20 of the maximum allowable plan limit after inflationary changes. 2020-45 keeps the limit at 550 for 2021. Generally under these plans an employer allows its employees to set aside a certain amount of pre-tax wages to pay for medical care and dependent care expenses.

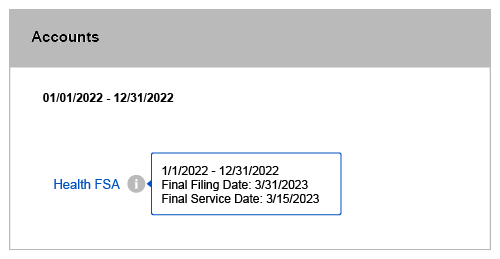

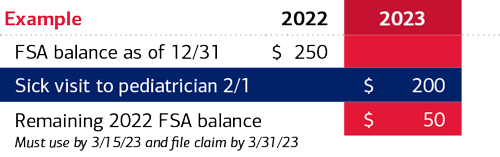

The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. Any unused fsa dollars at the end of the year can be used until march 15 th 2023 to pay for 2022 eligible expenses bek health care fsa pay for eligible medical dental or vision. For plan year 2022 in which the HCFSALEXHCFSA contribution limit is 2850 employees can carry over 20 percent of 2850 or 570 to the 2023 plan year.

Health-care FSAs can be used for a variety of medical expenses ranging from. Dependent care FSA limits remain unchanged at 5000 a year for individuals or married couples filing jointly or 2500 for a married person filing separately. Each spouse in the household may contribute up to the limit.

2020-45 keeps the limit at 550 for 2021. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. As a result the IRS has revised contribution limits for 2022.

Earlier this year the IRS issued Notice 2020-33 to increase the maximum Health Care FSA carryover amount to 550 or 20 of the Health Care FSA maximum contribution for plan. No limits to carrying over funds. Special rule regarding post-termination reimbursement from healthcare FSAs.

Total contributions for both the employer and employee cannot exceed 5000 for Dependent Care FSAs any amount exceeding that is taxable income. Dependent Care FSAs which previously allowed no carryover also have an unlimited carryover provision in 2021-2022. The amount of money employees could carry over to the next calendar year was limited to 550.

Your employer may elect a lower contribution limit. For spouses filing jointly each spouse can elect up to the health care max in the year in 2022 that would be 2850 2850 5700 household total. This dollar limit is indexed for cost-of-living adjustments and may be increased each year.

2021 healthcare FSA contribution limit For 2020 the IRS raised the FSA contribution cap to 2750 an additional 50 more than the previous year. In addition as part of COVID-19 relief the. As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and 2021.

2021-R-0054 February 11 2021 Page 3 of 4 unused health and dependent care FSA funds are forfeited at the end of the plan year known as the use it or lose it rule IRS Notice 2005-42. But employers may offer either a grace period or a carryover but not both to health FSA participants under certain circumstances. FSAs only have one limit for individual and family health plan participation but if you and your spouse are lucky enough to each be offered an FSA at work you can.

You dont pay taxes on this money. Allowing certain mid-year election changes for. For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022.

For 2022 participants may contribute up to an annual maximum of 2850 for a HCFSA or LEX HCFSA. The monthly limit for transportation in a commuter highway vehicle and transit pass provided by an employer to its employees will also remain at 270 per month in 2021. This means that the limit is increasing to 550 for 2020 20 of the 2750 limit on salary reduction contributions.

The limit is per person. Pay With Any FSA Card. However the Act allows unlimited funds to be carried over from plan year 2021 to 2022.

The Internal Revenue Service IRS has announced an increase in the Flexible Spending Account FSA contribution limits for the Health Care Flexible Spending Account HCFSA and the Limited Expense Health Care FSA LEX HCFSA.

Understanding The Year End Spending Rules For Your Health Account

2021 Year Planner Hra Consulting Photo Yearly Planner Calendar Examples Planner

Irs Adjusts Health Flexible Spending Account Other 2022 Limits

Can Employers Add To Employee Health Fsa Contribution Core Documents

Irs Announces 2021 Health Fsa Qualified Transportation Limits Lyons Companies

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

2022 Transportation Health Fsa And Archer Msa Limits Projected Mercer

Can Employers Add To Employee Health Fsa Contribution Core Documents

2021 Health Fsa Other Health And Fringe Benefit Limits Now Set Mercer

Understanding The Year End Spending Rules For Your Health Account

:max_bytes(150000):strip_icc()/hra-vs-hsa-5190731_final-eec8d019c0a545009e049f4a96861d85.png)

Health Reimbursement Arrangement Hra Vs Health Savings Account Hsa

Fsa Contribution Limits 2021 Health Savings Account Personal Budget High Deductible Health Plan

Irs Releases Fsa Contribution Limits For 2022 Primepay

The 2021 Limits For Fsa Commuter Benefits And Adoption Assistance

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

Hra Vs Fsa See The Benefits Of Each Wex Inc

Money Illustrated As If It Was A Patient In A Medical Laboratory Financial Health Credit Card Balance Financial Wellness

Understanding The Year End Spending Rules For Your Health Account